Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

Editorials & Other Articles

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

S&P 500 closed Friday 12/12 at 6827, down 1.1% # AI stock Broadcom disappoints after yesterday's Oracle disappointment [View all]

This discussion thread is pinned.

Last edited Fri Dec 12, 2025, 07:51 PM - Edit history (221)

In the future I will only be doing these twice a week: Tuesday and Friday, unless it's really interesting.10 Year TREASURY YIELD 4.19% on 12/12, +0.05 (It local-bottomed out at 3.95% 10/22/25, its lowest point since April.)

https://finance.yahoo.com/quote/%5ETNX/

Bitcoin: (at 6:09 PM ET 12/12 ) 90,381, down 2.24% for the day. It has wiped out all its gains for 2025 -- it ended 2024 at $93,429. It's in bear market territory, down more than 20% from it's $126,000+ all-time high in October (actually down 28% from that level)

Market news of the day: https://finance.yahoo.com/

How to find the latest Yahoo Finance "stock market today" report if it's not at the finance.yahoo page: click on

https://www.google.com/search?q=%22stock+market+today%22+site%3Afinance.yahoo.com&oq=%22stock+market+today%22+site%3Afinance.yahoo.com

If the link doesn't work for you,

Google: "stock market today" site:finance.yahoo.com

https://finance.yahoo.com/news/live/stock-market-today-dow-sp-500-nasdaq-sink-to-cap-brutal-week-for-tech-stocks-210016552.html

Stock market today: Dow, S&P 500, Nasdaq sink to cap brutal week for tech stocks, Yahoo Finance, 12/12/25

US stocks turned sharply lower on Friday, with the Nasdaq leading the way lower amid a broader rotation from tech to value names.

The Nasdaq Composite (^IXIC) fell 1.6%, continuing a tech slump. The S&P 500 (^GSPC) dropped roughly 1%, one day after surging above the 6,900 level for the first time. The Dow Jones Industrial Average (^DJI), which includes fewer tech stocks, slipped 0.5%.

Friday's moves cemented a brutal week for tech stocks in particular, with the Nasdaq down 1.6% and the S&P 500 down 1%. The Dow bucked the weekly trend, rising 1% for the week.

Treasury yields rose, with the 10-year yield (^TNX) stepping higher to top 4.18% and the 30-year yield (^TYX) rising above 4.85%.

Investors are switching out of tech as fears about AI over-valuations get a reboot, as Broadcom (AVGO) followed Oracle (ORCL) in delivering earnings that left Wall Street wanting more. The chipmaker failed to deliver clarity on an AI payoff, stirring concerns about tighter profit margins instead. Its shares dropped over 10% Friday, despite its quarterly earnings beat.

At the same time, cyclical stocks — those more sensitive to the economy — got a bid following the Federal Reserve's third interest rate cut of the year. The expected easing comes amid rising optimism for US growth, helping drive broader bullishness for stocks. The rate cut also helped drive gold prices (GC=F) to touch a fresh record as the precious metal is set for its best year since 1979.

Late Friday, President Trump indicated he considers Kevin Hassett the frontrunner for the next Fed chair after Jerome Powell's term expires in May. Trump said Kevin Warsh is also in contention for the role, which has been closely watched for its influence on monetary policy next year.

On the corporate front, Lululemon (LULU) shares surged more than 9% after the athletic wear maker said CEO Calvin McDonald will exit at the end of January following a stretch of disappointing sales.

US stocks turned sharply lower on Friday, with the Nasdaq leading the way lower amid a broader rotation from tech to value names.

The Nasdaq Composite (^IXIC) fell 1.6%, continuing a tech slump. The S&P 500 (^GSPC) dropped roughly 1%, one day after surging above the 6,900 level for the first time. The Dow Jones Industrial Average (^DJI), which includes fewer tech stocks, slipped 0.5%.

Friday's moves cemented a brutal week for tech stocks in particular, with the Nasdaq down 1.6% and the S&P 500 down 1%. The Dow bucked the weekly trend, rising 1% for the week.

Treasury yields rose, with the 10-year yield (^TNX) stepping higher to top 4.18% and the 30-year yield (^TYX) rising above 4.85%.

Investors are switching out of tech as fears about AI over-valuations get a reboot, as Broadcom (AVGO) followed Oracle (ORCL) in delivering earnings that left Wall Street wanting more. The chipmaker failed to deliver clarity on an AI payoff, stirring concerns about tighter profit margins instead. Its shares dropped over 10% Friday, despite its quarterly earnings beat.

At the same time, cyclical stocks — those more sensitive to the economy — got a bid following the Federal Reserve's third interest rate cut of the year. The expected easing comes amid rising optimism for US growth, helping drive broader bullishness for stocks. The rate cut also helped drive gold prices (GC=F) to touch a fresh record as the precious metal is set for its best year since 1979.

Late Friday, President Trump indicated he considers Kevin Hassett the frontrunner for the next Fed chair after Jerome Powell's term expires in May. Trump said Kevin Warsh is also in contention for the role, which has been closely watched for its influence on monetary policy next year.

On the corporate front, Lululemon (LULU) shares surged more than 9% after the athletic wear maker said CEO Calvin McDonald will exit at the end of January following a stretch of disappointing sales.

Scroll down to see earlier in the day reports

Please don't believe the fabrication that Fed Chair Powell said, or implied, that the jobs numbers are "fudged". He did not. The person posting that claim included no excerpt that one can read to judge what exactly he said, and that was deliberate. When confronted, that person expressed some other reasons (again without supporting information) for believing the numbers are fudged. That may be so, But that does not excuse very deliberately misleading one's fellow progressives about what Powell said.

Please don't believe reports that 1 million or 1.1 million jobs were lost in 2025 so far, implying these are net job losses (jobs lost minus jobs gained). This is based on Challenger, Gray, and Christmas that reported 1,170,821 job cuts were ANNOUNCED. And they are just layoff announcements, and they are not net of hiring announcements or any actual hiring. As the monthly JOLTS (Job Openings and Labor Turnover Survey) shows, there are a lot of layoffs (and voluntary leavings of jobs) and a lot of hiring every month. The excuse that media misreports the Challenger report too is not an excuse for deliberately misleading one's fellow progressives, after being presented with the information about what the Challenger etc. report actually said.

The media mis-reports a lot of things like Biden's supposedly weak economic record with cherry-picked misleading factoids, but that is never an excuse for echoing those reports here.

========

Coming up, reports (I'm also keeping the Dec 8 - Dec 12 ones for now)

https://www.marketwatch.com/economy-politics/calendar

The government reports are all seasonally adjusted, so please don't post comments about how the numbers look good (or not as bad as expected) only because of Christmas season hires -- seasonal factors like that have been adjusted for

TUE December 9:

* NFIB (National Federation of Independent Businesses) Optimism index, (non-govt) - I haven't looked at this yet, except that a headline said it improved. Here is a link: https://www.nfib.com/news/press-release/new-nfib-survey-small-business-optimism-edges-up-in-november/

* JOLTS (Jobs Opening and Labor Turnover Survey) (govt) - An unexpected tick up in job openings (albeit very tiny tick up), but layoffs jumped -- https://finance.yahoo.com/news/job-openings-inched-up-in-october-but-labor-market-worries-persist-152702311.html

DU thread: https://www.democraticunderground.com/10143579632

WED December 10:

* Employment Cost Index for Q3 (govt)

* FOMC Interest rate decision at 2 pm ET - a quarter point rate cut as was widely expected

THUR DECEMBER 11:

* Weekly unemployment insurance claims (govt) - initial claims made a big jump to 236,000, after a big dive the previous week which was Thanksgiving week. DU LBN thread: https://www.democraticunderground.com/10143580644 -progree

* Trade deficit (govt) - I didn't see this report

TUE DECEMBER 16:

The long-delayed big Jobs report (featuring the headline non-farm payroll jobs and unemployment rate) (govt). Expected: +50,000 jobs in November and 4.5% unemployment rate.

There was not, and never will be a separate October jobs report. The payroll stuff Establishment survey was taken and will be included in the November report. The household survey that produces the unemployment rate was not done in October, and so the October unemployment rate will be a blank in the records forever.

Retail Sales for October (delayed, govt)

S&P flash U.S. services and manufacturing PMI's (non-govt)

THUR DECEMBER 18:

Weekly unemployment insurance claims for the week ending Dec 13 (it was 236,000 for the week ending Dec 6) (govt)

Consumer price index for November (govt) (note: the one for October was cancelled. The November one was originally scheduled for December 10 before the Fed's rate-setting meeting, but alas was delayed until 8 days after the meeting)

FRIDAY DECEMBER 19

Existing home sales (non-govt)

Consumer Sentiment final (non-govt)

Revised release dates for Bureau of Labor Statistics reports: https://www.bls.gov/bls/2025-lapse-revised-release-dates.htm

=============================================

The S&P 500 closed Friday December 12 at 6827, down 1.1% for the day,

and up 18.1% from the 5783 election day closing level,

and up 13.8% from the inauguration eve closing level,

and up 16.1% year-to-date (since the December 31 close)

and down 0.9% from it recent October 28 high.

S&P 500

# Election day close (11/5/24) 5783

# Last close before inauguration day: (1/17/25): 5997

# 2024 year-end close (12/31/24): 5882

# Trump II era low point (going all the way back to election day Nov5): 4983 on April 8

# October 28 all-time-high: 6890.90, surpassed by December 11's all-time high of 6901.00

# Several market indexes: https://finance.yahoo.com/

# S&P 500: https://finance.yahoo.com/quote/%5EGSPC/

https://finance.yahoo.com/quote/%5EGSPC/history/

Bitcoin

Bitcoin ended 2024 at $93,429. https://finance.yahoo.com/quote/BTC-USD/

Bitcoin's all-time interday high: 126,198 on Oct. 6

Bitcoin's all-time closing high: 124,753 on Oct 6.

https://finance.yahoo.com/quote/BTC-USD/history/

========================================================

I'm not a fan of the DOW as it is a cherry-picked collection of just 30 stocks that are price-weighted, which is silly. It's as asinine as judging consumer price inflation by picking 30 blue chip consumer items, and weighting them according to their prices. But since there is an automatically updating embedded graphic, here it is. It takes several, like 6 hours, after the close for it to update, like about 10 PM EDT.

(If it still isn't updated, try right-clicking on it and opening in a new tab. #OR# click on https://finance.yahoo.com/quote/%5EDJI/ ).

The Dow closed Thrusday at 48,704, and it closed Friday at 48,458, a drop of 0.5% (246 points) for the day

https://finance.yahoo.com/

DOW: https://finance.yahoo.com/quote/%5EDJI/

. . . . . . https://finance.yahoo.com/quote/%5EDJI/history/

DOW

# Election day close (11/5/24) 42,222

# Last close before inauguration day: (1/17/25): 43,488

# 2024 year-end close (12/31/24): 42,544

DJIA means Dow Jones Industrials Average. It takes about 6 hours after the close to update, so check it after 10 PM EDT. Sometimes it takes a couple days (sigh)

I don't have an embeddable graph for the S&P 500, unfortunately, but to see its graph, click on https://finance.yahoo.com/quote/%5EGSPC/

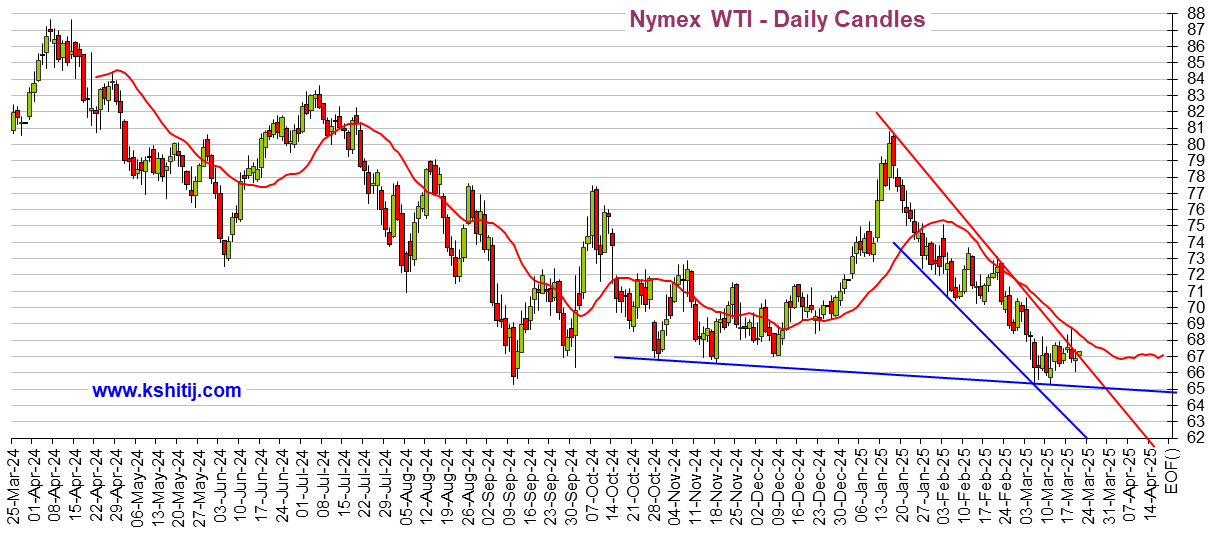

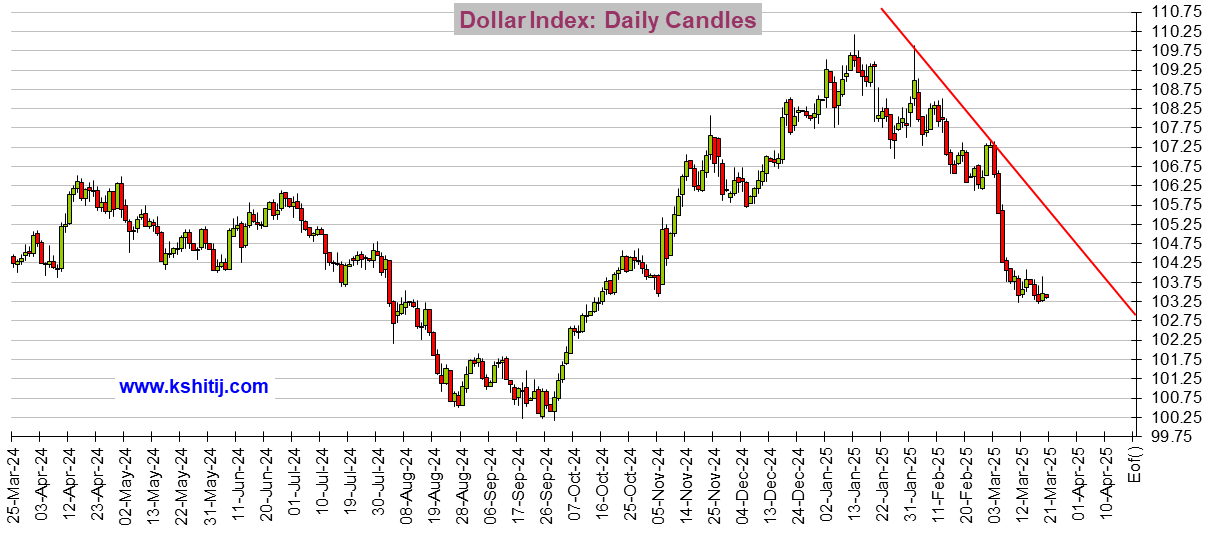

While I'm at it, I might as well show Oil and the Dollar:

Crude Oil

US Dollar Index (DX-Y.NYB)

If you see a tiny graphics square above and no graph, right click on the square and choose "load image". There should be a total of 3 graphs. And remember that it typically takes about 6 hours after the close before these graphs update.

🚨 ❤️ 😬! 😱 < - - emoticon library for future uses

19 replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

S&P 500 closed Friday 12/12 at 6827, down 1.1% # AI stock Broadcom disappoints after yesterday's Oracle disappointment [View all]

progree

Mar 2025

OP

Kicking for the milestone update - S&P 500's first close below the election day close. How major indexes fared:

progree

Mar 2025

#1

Kicking: update for Thurs. March 6 close. The "Trump Trade" is back underwater after losing 1.8% for the day (S&P 500)

progree

Mar 2025

#2

Kicking: Update: S&P 500 closed Friday at 5770, up 0.5% for the day but still below the election day close

progree

Mar 2025

#3

Update: S&P 500 closed Monday 3/10 at 5615, down 2.7% for the day and 2.9% below the election day close

progree

Mar 2025

#4

Update: S&P 500 closed Tuesday 3/11 at 5572, down 0.8% for the day, briefly fell into correction territory

progree

Mar 2025

#5

S&P 500 closed Wednesday 3/12 at 5599, up 0.5% for the day, but down 3.2% since election day

progree

Mar 2025

#6

Update: S&P 500 closed Thursday at 5522, down 1.4% for the day, and MORE THAN 10% down from the all-time high

progree

Mar 2025

#7

Update: S&P 500 closed Friday at 5639, up 2.1% for the day, and down 2.5% since election day

progree

Mar 2025

#8

Update: S&P 500 closed Monday at 5675, up 0.6% for the day, and down 1.9% since election day

progree

Mar 2025

#9

Update: S&P 500 closed Tuesday at 5615, down 1.1% for the day, and down 2.9% since election day

progree

Mar 2025

#10

S&P 500 closed Tuesday 3/25 at 5777, up 0.2% for the day, down 0.1% since election day, down 6.0% from ATH

progree

Mar 2025

#11